2025 Expectations: We continue to be cautiously optimistic that equity markets can continue to perform well, albeit with elevated headline and concentration related volatility.

Benign Bond Markets: Stability was the word of the month for fixed income markets, as economic data and the Fed meeting did little to move rates.

Even Given the Volatility, Equity Markets Finished Higher Broad gains across the board as investor sentiment remained high, with positive data and earnings offsetting tariff and interest rate concerns.

FOMC Meeting Went as Expected: The Federal Reserve maintained its benchmark borrowing rate at a range of 4.25%-4.50% and reiterated its data-dependent approach to monetary policy.

Equity Market Concentration Downside on Display: We saw the potential pitfalls of equity market concentration on January 27th.

Traders Continue to Debate How Much Fed Will Cut Next Year Futures: Futures markets have lowered the number of cuts they are expecting next year, currently pricing in ~0.50% of easing.

Equity Markets

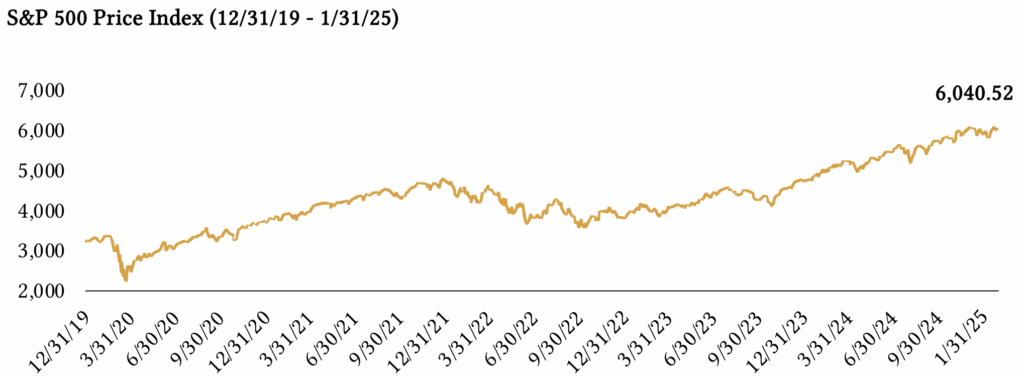

US Equity indices got off to a good, albeit volatile, start to 2025, with broad gains across the board as investor sentiment remained high. The positives outweighed the negatives, with resilient economic data, continued corporate earnings growth offsetting investor concerns about potential tariffs, interest rates remaining higher for longer, and an AI-related selloff in technology shares. In terms of S&P 500 sector performance, Communication Services performed the best, driven higher by strong earnings reports from Meta and Netflix. The worst performing sector was Technology, mainly as a result of the DeepSeek related sell-off on January 27th.

Elevated Headline Volatility

Elevated Headline Volatility

Performance Review & Outlook

Highlights

4.25%-4.50% and reiterated its data-dependent approach to monetary policy.

Equity Markets

US Equity indices got off to a good, albeit volatile, start to 2025, with broad gains across the board as investor sentiment remained high. The positives outweighed the negatives, with resilient economic data, continued corporate earnings growth offsetting investor concerns about potential tariffs, interest rates remaining higher for longer, and an AI-related selloff in technology shares.

In terms of S&P 500 sector performance, Communication Services performed the best, driven higher by strong earnings reports from Meta and Netflix. The worst performing sector was Technology, mainly as a result of the DeepSeek related sell-off on January 27th.

In terms of S&P 500 sector performance, Communication Services performed the best, driven higher by strong earnings reports from Meta and Netflix. The worst performing sector was Technology, mainly as a result of the DeepSeek related sell-off on January 27th.

Dreams are important.

Aspirations are what help make goals reality.