NBCS Asset Management

NBCS Asset Management, a division of NBC Securities, Inc., is primarily focused on providing high quality investment management solutions in the form of separately managed accounts.

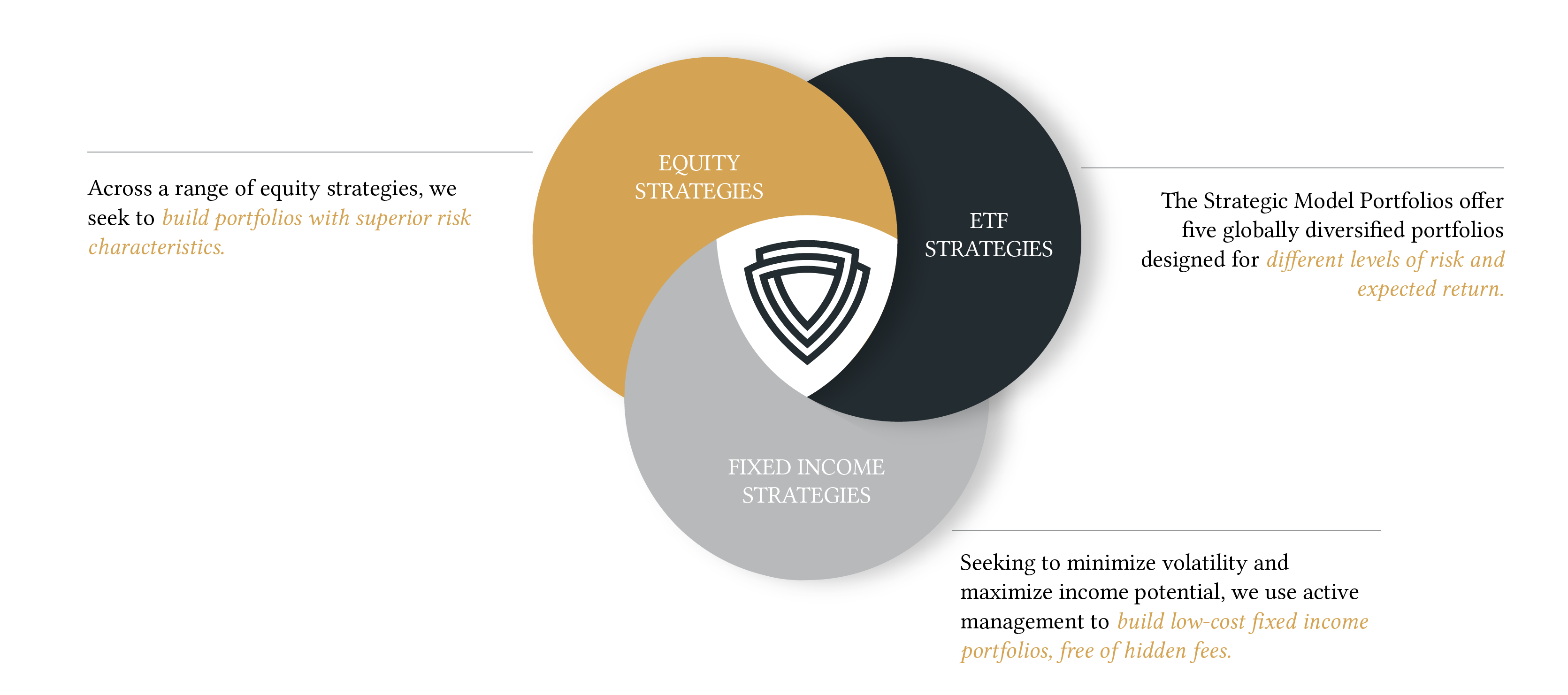

Strategies

Investment Process

Across a range of equity strategies, we seek to build portfolios with superior risk characteristics, while utilizing the support of Revelation Investment Research for a quantitative equity research process.

- Equity Income

- Core Equity

- Focus Growth

Revelation Investment Research

We have partnered with Revelation Investment Research for quantitative equity research. Revelation is guided by a strong belief system rooted in years of investment research. Revelation believes the ability to systematically predict which stocks have the most and least downside risk is a first step in building portfolios with quality first. RIR analyzes stock-specific risk using 12 diverse research concepts with an intuitive risk rationale, most of which have been validated by independent academic or practitioner research. Employing a weight-of-the-evidence approach, the 12 input scores are combined into a single overall rating used in a disciplined portfolio management process where stocks rated as having the least downside risk are purchase candidates, while those rated as having the most downside risk are to be avoided or sold.

Pierre G. Allard

Chief Investment Officer

Darren Hinshaw

Director of Research

Christopher Fidler

Director Fixed Income Trading & NBCSAM Fixed Income Portfolio Manager

Backed by two decades of fixed income sales and trading experience, our team seeks to minimize volatility and maximize income potential through active management across tailored portfolios, free of hidden fees.

- Municipal

- Corporate

- Government

- Fixed Income ETF

Fixed Income Approach

Our fixed income strategic focus begins with the big picture, followed by the utilization of individual bonds over bond funds in order to enable the ability to minimize volatility and risk in client bond portfolios while maximizing income potential. We use active management to build low cost FI portfolios driven by extensive research from S&P and Moody’s credit services, resources from our clearing firm RBC, and the MSRB. We also drill down to the granular level by leveraging NBCS trader research including, but not limited to: debt coverage rations, cash on hand, and balance sheet research, and financial statements.

Christopher Fidler

Director Fixed Income Trading & NBCSAM Fixed Income Portfolio Manager

- Conservative

- Moderate Conservative

- Moderate

- Moderate Growth

- Growth

ETF Approach

Each allocation is constructed for a distinct balance between risk tolerance and expected long-term returns. They range from conservative, which focuses on income and capital preservation, to aggressive, which targets long-term growth. The Portfolios are rebalanced semi-annually to keep their allocations consistent with their target weights.

Pierre G. Allard

Chief Investment Officer

Darren Hinshaw

Director of Research

Christopher Fidler

Director Fixed Income Trading & NBCSAM Fixed Income Portfolio Manager

The Core+ Strategies combine passive and active investments to achieve a balanced approach, aimed at reducing volatility, promoting diversification, and effectively managing risk. The primary goal of the portfolios’ core equity holding is to surpass the performance of the Russell 1000 index throughout a complete market cycle, while maintaining lower levels of volatility. All of the strategies are comprised of 40 US stocks that are equally weighted, selected based on Revelation Investment Research’s (RIR) quantitative equity ranking algorithm. The equity ETF positions within the portfolio are strategically diversified across various asset classes.

- Core Plus Municipal Bonds

- Core Plus Individual Taxable Bonds

- Core Plus Muni Bond ETFs

- Core Plus Taxable Bond ETFs

Darren Hinshaw

Director of Research

Christopher Fidler

Director Fixed Income Trading & NBCSAM Fixed Income Portfolio Manager